In a collaborative effort between Global Equity Strategy and Global Asset Allocation, and in keeping with their year-end tradition, UBS presented in their final publication of 2008 a list of ten possible ‘surprises’ for the coming year. Its aim is to identify plausible scenarios, representing risks—up or down—to investor consensus thinking, and in some cases, to its own views.

In a collaborative effort between Global Equity Strategy and Global Asset Allocation, and in keeping with their year-end tradition, UBS presented in their final publication of 2008 a list of ten possible ‘surprises’ for the coming year. Its aim is to identify plausible scenarios, representing risks—up or down—to investor consensus thinking, and in some cases, to its own views.UBS' list of ‘surprises’ include:

1) Corporate default rates don’t rise significantly;

2) Oil prices fall below $20 per barrel;

3) The dollar falls to new lifetime lows;

4) Breakeven inflation rates remain near zero;

5) Global growth is negative for 2009;

6) The Fed purchases corporate credit;

7) Emerging markets regain parity valuations;

8) Equity ‘fallen angels’ soar;

9) Obama pushes for a ‘tax holiday’; and,

10) Gold goes to $300.

Perhaps next year the surprises will be somewhat more positive? Who knows! Now let us take a look at their last years' surprises (predictions) and compare their conjectures to actual outcomes.

1) Global growth surprises on the upside: Did it happen? No.

2) Oil prices: Is 50 the new 20? Did it happen? Yes.

3) The dollar appreciates: Did it happen? Yes.

4) World trade clouds: Did it happen? Sort of.

5) Developed deflation, developing inflation: Did it happen? No.

6) Financials outperform: Did it happen? No.

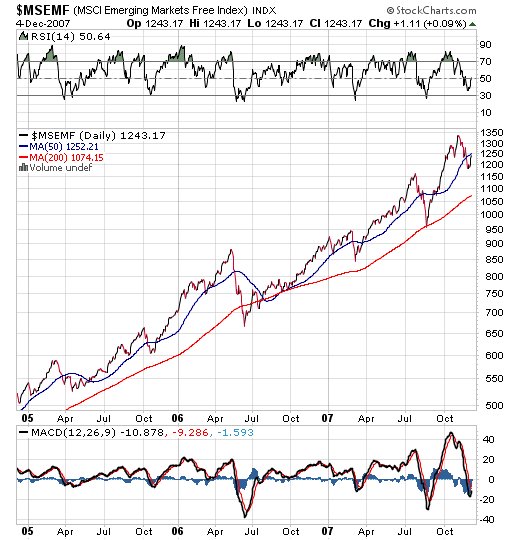

7) Emerging equity markets under-perform: Did it happen? Yes.

8) Japanese equities outperform: Did it happen? It depends.

9) Equity volatility settles at lower levels: Did it happen? No.

10) Chinese inflation falls sharply: Did it happen? Yes.

With a success ratio of 40% in their last year's predictions it attests that this exercise has merit. At least it can provide an avenue for 'out of the box' thinking which can aid risk management. Whether their predictions hold good or live upto its own benchmark is a question that only time can answer. Let's wait and watch!!

India's corporate optimism has sunk on worries about the global economy and weakening demand, according to a new survey on Monday, as the stock market and rupee fell to fresh lows. Some 57 percent of the 348 firms in the cross-sector survey reported Asia's third-largest economy had grown

India's corporate optimism has sunk on worries about the global economy and weakening demand, according to a new survey on Monday, as the stock market and rupee fell to fresh lows. Some 57 percent of the 348 firms in the cross-sector survey reported Asia's third-largest economy had grown