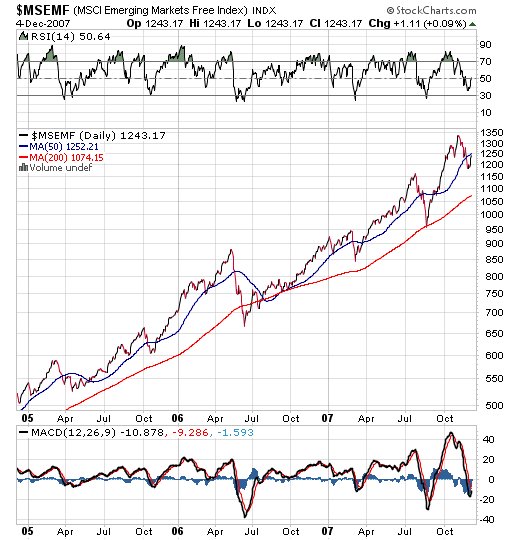

The Morgan Stanley Capital International (MSCI) emerging markets stock index is down 55 percent year-to-date. Investors caught up in the credit crisis sold their profitable emerging market positions in order to raise cash to protect their core positions. This deleveraging process has been indiscriminate across regions, countries and asset classes and continues even as central banks and governments shove cash into the markets in order to keep up the flow of money in the credit markets.

But, emerging market equity prices are expected to bounce back from the indiscriminate dumping of the sector faster than developed stock markets. In particular, Asian emerging market stocks are now expected to outperform their peers because the sharp decline in commodity prices will bring down their manufacturing costs and make them more competitive in exports as well as feed resilient domestic demand.

China's benchmark Shanghai Composite Index is down nearly 65 % year-to-date while India's 30-share BSE Index is down 51.50 % over the same period. India is a lot less expensive than they were but nevertheless, relative to other emerging markets, it remains one of the more expensive stock markets. Russia at 3.5 times perspective earnings versus 7.5 times for emerging generally makes Russia cheapest market in the world. As for Egypt, it tends to have a relatively low correlation with both developed and emerging markets because it is under-owned and has more investment coming from the region or from domestic sources.