According to experts, mistaken identity is not new to Indian markets. According to them, retail investors are often swayed by one of two sales pitches by brokers. In one, brokers actually put investors on notice of such mistaken identity but would advise that investors should go along with the price movements and exit on registering a small profit. In the other, they may keep investors in the dark (mistaken identity), and end their recommendation with a caution that investors should do their own due diligence before investing.

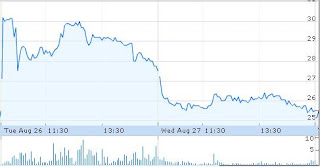

Marketmen said that recently when stock market was upbeat on Reliance Group, shares of Reliance Chemotex Industries, a textile company, also surged along with them though it was not part of Reliance group. From a 52-week low of Rs 19.8 (August 2007), the stock had touched a high of Rs 182 (November 2007), but is now ruling at around Rs 45.

2 comments:

this is quite common. for example when tata tea declares a good result, all the tata line of stocks inclusing TCS have a positive impact. Measuring apples for organes is an old practice in India.

I think Rahul is correct. The increase in a performance of one company has a positive impact on the shares of other SBU's under the same parent organization.

Post a Comment